(27 February 2024, Hong Kong) NWS Holdings Limited (the “Company” and its subsidiaries, collectively, “NWS” or the “Group”; Hong Kong stock code: 659) today announced its interim results for the six months ended 31 December 2023 (the “Current Period” or “1HFY2024”).

HIGHLIGHTS

Healthy Financial Position

In the Current Period, NWS maintained a healthy financial position. The Group’s total available liquidity amounted

to HK$30.4 billion as at 31 December 2023, comprising cash and bank balances of HK$20.1 billion and unutilized

committed banking facilities of HK$10.3 billion. For the outstanding principal amount of US$1,019.1 million of the

2019 Perpetual Capital Securities, the Group redeemed the whole outstanding amount at par using internal resources

and external borrowings on its first call date on 31 January 2024.

After including the 2019 Perpetual Capital Securities as debt upon the issuance of notice of redemption in December

2023, net gearing ratio, calculated as net debt over total equity, rose to 30% as at 31 December 2023 (for illustration

purpose, assuming the same outstanding amount of the 2019 Perpetual Capital Securities was included as debt as at

30 June 2023, pro-forma net gearing ratio as at 30 June 2023 would be approximately 27%).

Proactive Financial Management

To mitigate the risk of escalating interest rates of Hong Kong Dollar borrowings and the negative impact on the Group’s equity due to Renminbi depreciation, the Group further optimized its debt profile and increased the proportion of its Renminbi borrowings to total debts.

In November 2023, the Group issued the second tranche of RMB-denominated medium-term notes (the “Panda Bonds”) with a principal amount of RMB2.0 billion, an annual interest rate of 3.9% and a tenor of 3 years. The proceeds from this tranche of the Panda Bonds were earmarked for repayment of the Group’s offshore debts. As at 31 December 2023, the Group has issued a total principal amount of RMB3.5 billion of the Panda Bonds. Additionally, the sustainability-linked facilities increased to approximately HK$6.5 billion as at 31 December 2023.

Business Performance Highlights

In 1H2024, Mainland visitors accounted for over 50% of the overall APE, well above the pre-COVID-19 level. Gross

written premium increased by 21% year-on-year to HK$7,659.3 million. Value of New Business (“VONB”), spurred by the stellar growth in APE, surged by 207% year-on-year to HK$677.8 million. As at 31 December 2023, FTLife Insurance’s solvency ratio was 314%, well above the minimum industry regulatory requirement of

150%. In the first nine months of 2023, FTLife Insurance’s ranking among Hong Kong life insurance companies by

APE stood at 10th

.

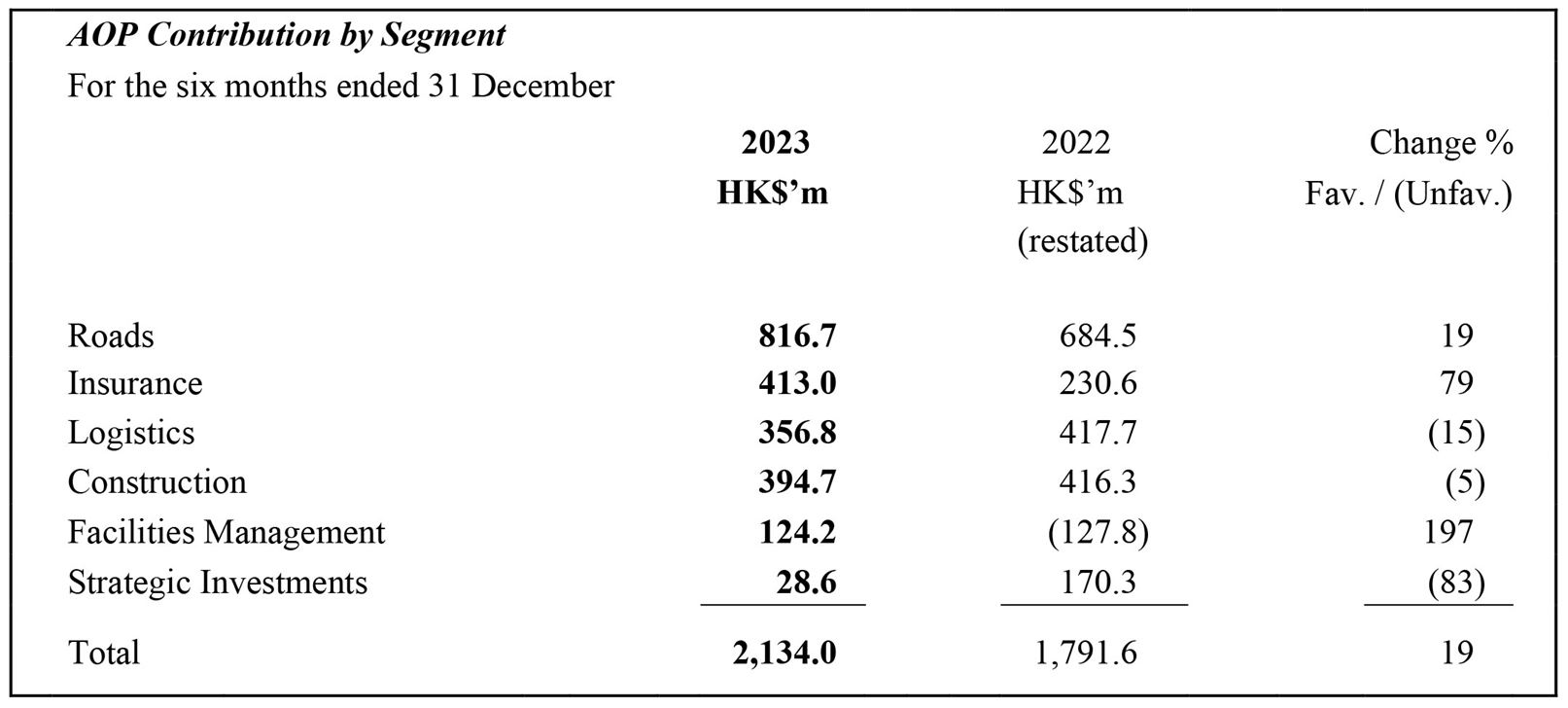

Logistics

Logistics segment registered stable operating performance during the Current Period. Yet, the absence of revaluation

gain for ATL Logistics Centre Hong Kong (“ATL”) and logistics properties in the Mainland within Logistics Asset

& Management (“LA&M”) in the Current Period, along with the decline in AOP contribution from China United

International Rail Containers Co., Limited (“CUIRC”), the overall Logistics segment’s AOP was HK$356.8 million,

decreased by 15% year-on-year. Excluding the revaluation gain of the investment properties in the Last Period, AOP of the Logistics segment would increase by 4% year-on-year, and AOP of LA&M would increase by 8% year-on-year.

ATL contributed over 70% of the Logistics segment’s AOP, and demonstrated a resilient rental performance. As at

31 December 2023, the occupancy rate of ATL remained at almost fully let level of 98.9% (30 June 2023: 99.8%),

with average rent increased by 3% year-on-year.

The occupancy rate of the five logistics properties in Chengdu and Wuhan was 87.2% as at 31 December 2023 (30

June 2023: 90.1%). The new logistic property in Chengdu which was completed in January 2023 continued to ramp

up with occupancy rate improving to 84.8% as at 31 December 2023 (30 June 2023: 51.2%), while the newly acquired

logistics property in Suzhou maintained the occupancy rate at 100% as at 31 December 2023 (30 June 2023: 100.0%).

Strong demand for multimodal transportation services and an increase in terminal capacity continued to benefit China

United International Rail Containers Co., Limited, with throughput increasing by 20% year-on-year to 3,282,000

TEUs. Yet, owing to negative factors, including RMB depreciation, increase in operating expenses, and decrease in

other income, CUIRC saw an 18% year-on-year decline in AOP during the Current Period.

Construction

The Group’s Construction segment is principally engaged in building construction and related businesses in Hong

Kong through Hip Hing Group, Vibro Group and Quon Hing Group (collectively, “NWS Construction Group”), and

also has an 11.5% interest in Wai Kee Holdings Limited. In the Current Period, NWS Construction Group’s AOP

remained relatively stable at HK$394.7 million. New contracts secured by NWS Construction Group increased

by 207% year-on-year to HK$12.4 billion, while the gross value contracts on hand for the NWS Construction

Group amounted to approximately HK$61.9 billion, rising 9% from 30 June 2023.

Facilities Management

Business performance of Hong Kong Convention and Exhibition Centre (“HKCEC”) and Free Duty maintained its recovery trajectory, while EBITDA of Gleneagles Hospital Hong Kong (“GHK Hospital”) saw a decent growth in the Current Period. AOP of the Facilities Management segment was HK$124.2 million in 1H2024, versus an Attributable Operating Loss (“AOL”) of HK$127.8 million in the Last Period, significantly turning losses into profits.

HKCEC’s performance gained more steam, bolstered by the return of large-scale international and regional exhibitions and events as well as new events, supporting a turnaround to AOP versus AOL in the Last Period. Number of events rose by 7% year-on-year to 437 and total patronage surged by 15% year-on-year to 3.9 million.

Free Duty has been maintaining its recovery momentum. Free Duty recorded a slight AOP in 1H2024, compared with an AOL in the Last Period. Sales performance of outlets at Lok Ma Chau and Lo Wu continued to ramp up while Hong Kong-Zhuhai-Macao Bridge outlet continued to register a growth in AOP year-on-year.

GHK Hospital recorded growth in the number of inpatients by 31%, outpatients by 12%, and day cases by 1%, respectively. EBITDA of GHK Hospital grew by 284% year-on-year. In October 2023, the business venture of the Group and IHH Healthcare Berhad opened a new clinic in Wong Chuk Hang which provides a full spectrum of services, including specialist, imaging and health screening to expand its service network.

Outlook

NWS has entered 2024 with confidence, especially with the robust recovery and growth in its Operating Businesses.

Recognizing the uncertainties in the global economy, the Group remains vigilant. Going forward, the Group continues

to be prudent in its cash flow and capital management.

Mr. Brian Cheng, Co-Chief Executive Officer of NWS, said, “Underpinned by the Group’s agile and prudent

business strategy, coupled with the full support from Chow Tai Fook Group and strong leadership from our

experienced management team, the Group will make every effort to enhance value for and increase return to our

shareholders, as well as pursue investment opportunities with long-term sustainable growth.”

Mr. Gilbert Ho, Co-Chief Executive Officer of NWS, added, “In addition to the continued organic growth in

Insurance and Construction segments as well as continued improvement in Facilities Management segment, the

Group will actively seek new investment opportunities to enrich its roads and logistics portfolio, and anticipating that

these investments will bring long-term benefits and returns to the Group and our shareholders. At the same time, the

Group will continue to incorporate ESG considerations into investment decisions demonstrating our commitments to

responsible and sustainable practices.”

- End -

NWS Holdings Limited

Listed on The Stock Exchange of Hong Kong Limited, NWS Holdings Limited (Hong Kong Stock Code: 659) is a conglomerate with a diversified portfolio of market-leading businesses, predominantly in Hong Kong and the Mainland. The Group’s businesses include toll roads, insurance, logistics, construction and facilities management. Through the Group’s sustainable business model, it is committed to creating more value for all stakeholders and the community.

Media enquiries:

NWS Holdings Limited

Telephone: 2131 3801

Email: corpcomm@nws.com.hk